* Abbreviations:

PETI – Strategic Transport and Infrastructure Plan.

PNI – National Investment Program.

PVAE – Business Area Enhancement Program.

IP- Infraestruturas de Portugal faces the following challenges in the management of investment:

-

Greater effectiveness - Maintain permanent, physical and financial updating of activity planning and the respective execution of work, taking into account priority activities and their critical path;

-

Improved efficiency - Achieve lower costs as a result of better planning/control, application of optimized unit costs based on the general headings system and automation of interfaces (connection to procurement and financial platforms);

-

Improved alignment of strategy and execution - Carry out correct activities based on scenario analysis;

-

Lower Risk - Understand the risks associated with the portfolio of activities underway.

-

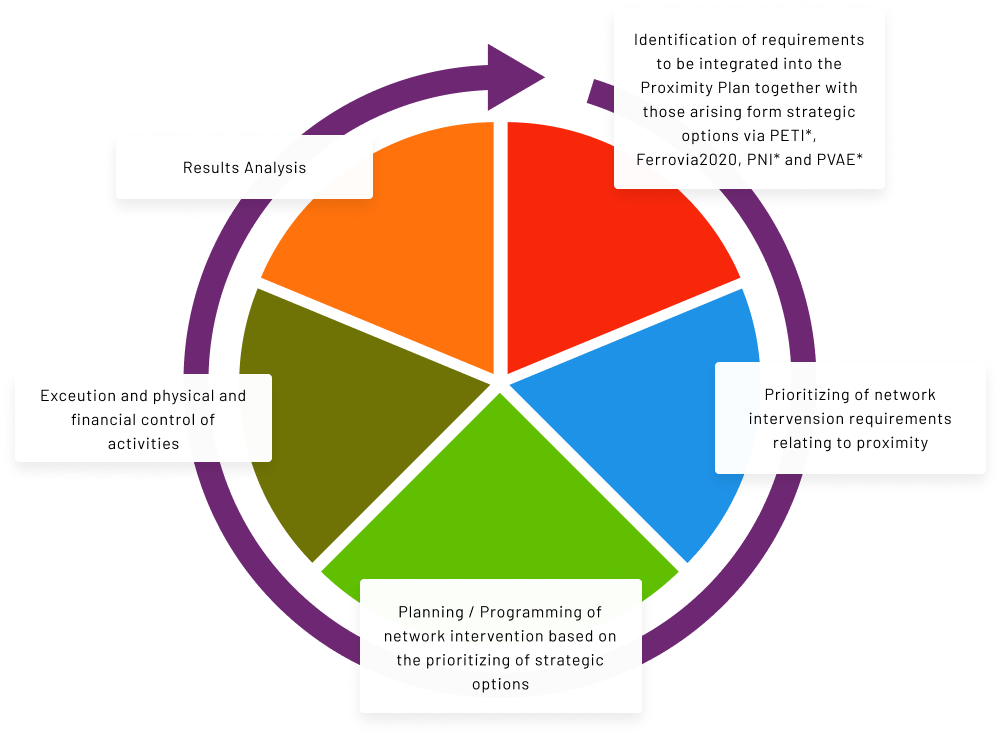

In response to these investment management challenges, a platform was developed called “General Integrated Planning (PGI)”, based on a project management methodology, shared throughout the company, which brings together all physical and financial information from the activities and initiatives portfolio and the Network Intervention Plan, from the design to the construction stages.

Advantages

-

A “General Integrated Planning” platform has clear advantages for any organization and particularly for an organization the size of IP, in the planning, management and monitoring of investment, as it allows:

-

A unique and shared view of planning and its implementation through a tool which is transversal and available to the entire organization and not just a limited number of departments;

-

Greater predictability in management as the planning and periodic updating of activities leads to the provision of more up to date information, thus facilitating decision making;

-

All individual mangers are able to manage their work which is facilitated through a base structure that is more receptive to the introduction of the desired specificities;

-

Greater budgetary control through interconnection of physical and financial activities plans;

-

Improved risk management as the platform provides for the timely identification of potential risks which could lead to cost and deadline overruns;

-

The integration of information through interfaces with applications;

-

Completing separate files is no longer required, and has been replaced with pre-defined and automated reporting.

Objectives

-

To create an integrated, physical and financial vision of the different investing activities (full cycle) which allows improved management and monitoring of investment;

-

For the organization to implement and share a single project management methodology.